Marketing Giant or Banking Innovator? The Polarizing Chime IPO Debate

The $500 million annual marketing spend fuels industry divide.

Fintech company Chime filed for a Nasdaq IPO last week, and the Bears and Bulls are debating!

Today, our Small Data Semantic Analysis is focused on Ron Shevlin`s LinkedIn post, which provoked interesting comments. Ron Shevlin is the Chief Research Officer at Cornerstone Advisors.

Ron`s hook: With all the fintech fanboy fanfare for Chime, I still don't see anybody asking some key questions!

Chime in a nutshell

Founded in 2012 and launched to the public in 2014, Chime has rapidly evolved into one of the leading neobanks in the United States, driven by its mission to "unite everyday people to Unlock Financial Progress™." Now 13 years old, Chime boasts 8.6 million active customers reported in early 2025. After reaching a peak valuation of $25 billion in 2021, Chime is expected to IPO with a valuation between $8 billion and $20 billion.

Summary of Ron`s post:

Ron Shevlin critically questions Chime’s long-term viability and growth strategy, highlighting its unusually high marketing spend (~$500 million annually) and expressing skepticism about the actual size of its addressable market and its profitability. He challenges the notion that Chime can easily transition from serving the underbanked to capturing the mainstream market, framing this through the lens of the “Innovator’s Dilemma.” Shevlin argues that if Chime’s market were truly lucrative, major banks would have pursued it already, implying that the opportunity may be overstated. He invites disagreement, asking readers to explain why his skepticism might be unfounded.

Summary of the Community’s Comments

Marketing Burn and Sustainability Doubts

Many commenters express concern over Chime’s exceptionally high marketing spend, questioning how long the company can sustain this “kindling fire” strategy without eventually igniting a self-sustaining business model. Several note that such spending far exceeds industry norms and may backfire if not backed by stronger product innovation or operational efficiency.

Skepticism Toward Chime’s Market and Mission

A recurring thread is doubt about the actual size and profitability of the underbanked market Chime claims to serve. Some suggest the narrative of “democratizing finance” is more about marketing than meaningful inclusion, and point out the disconnect between Chime’s stated mission and its execution, especially given decreasing tech investment over time.

Comparisons with Traditional Banks

Commenters debate whether legacy banks like Chase or Wells Fargo could (or would) effectively compete in Chime’s target market. While some argue traditional banks are structurally incapable or unwilling to serve lower-margin segments, others believe Chime’s advantages are temporary and not based on deeply differentiated offerings.

Exit Strategy and Investor Pressure

There’s broad agreement that Chime’s current trajectory is shaped by pressure from investors needing a profitable exit, via IPO. Some commenters observe that Chime’s investor base includes many major VCs, increasing the likelihood that market hype and growth optics are being prioritized over sustainable value creation.

Product Limitations and Platform Critique

A number of contributors with insider or fintech experience criticize Chime’s product as uninspiring and slow-moving, suggesting the real engine has always been marketing. Despite building its own core banking infrastructure (ChimeCore), skepticism remains around whether this will deliver a strategic or competitive advantage in a crowded and maturing space.

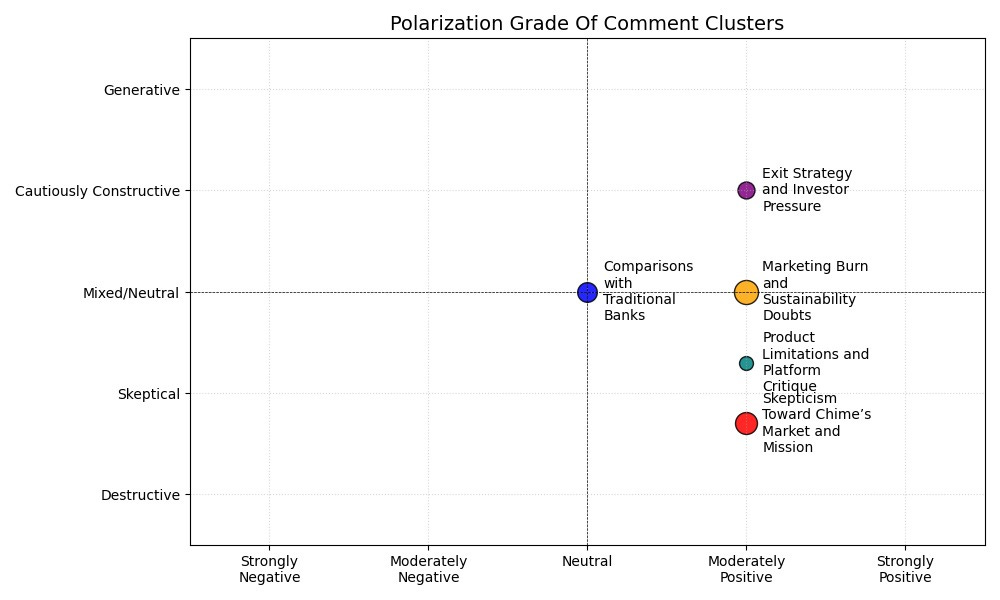

Polarization Matrix

The polarization of the comment clusters on Ron Shevlin’s Chime critique reveals a high degree of alignment with the author’s skepticism, though the tone and emphasis vary across clusters:

- Strong agreement dominates: Most commenters support Shevlin’s questioning of Chime’s marketing-heavy strategy and business fundamentals. Two clusters, "Marketing Burn and Sustainability Doubts" and "Skepticism Toward Chime’s Market and Mission", represent nearly 55% of the volume and echo his concerns, often intensifying them with financial, strategic, or anecdotal arguments.

- Constructive elaboration: Clusters like "Comparisons with Traditional Banks" and "Exit Strategy and Investor Pressure" bring additional context without refuting the core argument. They broaden the discussion with systemic comparisons and capital market dynamics, while still validating Shevlin’s critical lens.

- Minimal pushback: There's no strong oppositional cluster challenging the post's core premise. The final cluster, "Product Limitations and Platform Critique", also aligns with the author’s concerns, offering technical or strategic critiques rather than defenses of Chime.

In summary, the comment field is polarized in tone (some biting, some analytical) but not in stance. It forms a consensus chorus of concern rather than a debate, with Ron Shevlin’s skepticism about Chime functioning as a shared starting point rather than a point of contention.

Great read. The chart above shows more below the neutral line than above! That's not good. As to the marketing spend that isn't a good sign nor is it sustainable. It does raise real questions, but hey that's what asset managers get paid the big bucks for!

As you wrote in your LinkedIn post, Efi: "What struck me most was the remarkable alignment among commenters - not debate, but a 'consensus chorus of concern' amplifying Shevlin's skepticism."